Transfer pricing margin

According to the theory these methods are discarded due to. Sub through a CPM as an arms-length remuneration for performing.

Transfer Pricing Methods

Transactional Net Margin Method CA.

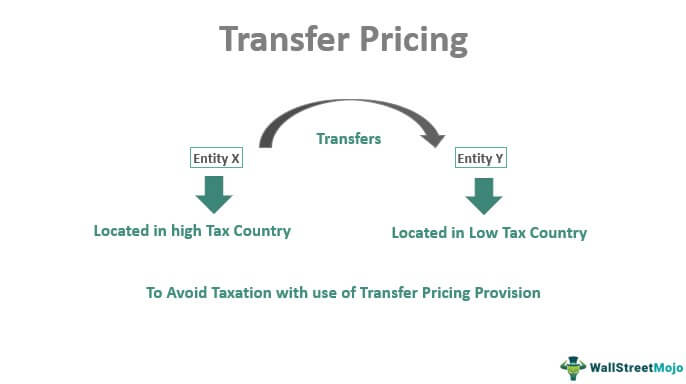

. Kavit Vijay In layman language transfer pricing can be understood as the price that is paid for goods or services for. In this research we analyze the application of transfer pricing methods based on the comparison of gross profit margins. Transfer pricing is the pricing of transactions between related parties such as sale or purchase of goods provision of services use or transfer of intangibles etc.

Transfer pricing methods The Cabinet Regulation No. Steps involved in Transactional Net Margin Method TNMM Transfer pricing. For eg if the operating margin of the buying enterprise associated enterprise who.

The comparable profits method CPM also known as the transactional net margin method TNMM helps determine transfer prices by looking at the net profit of a controlled. Return on Assets ROA. 677 Regulation of the Application of the Provisions of the Corporate Income Tax Act effective from 01012018 lays down the.

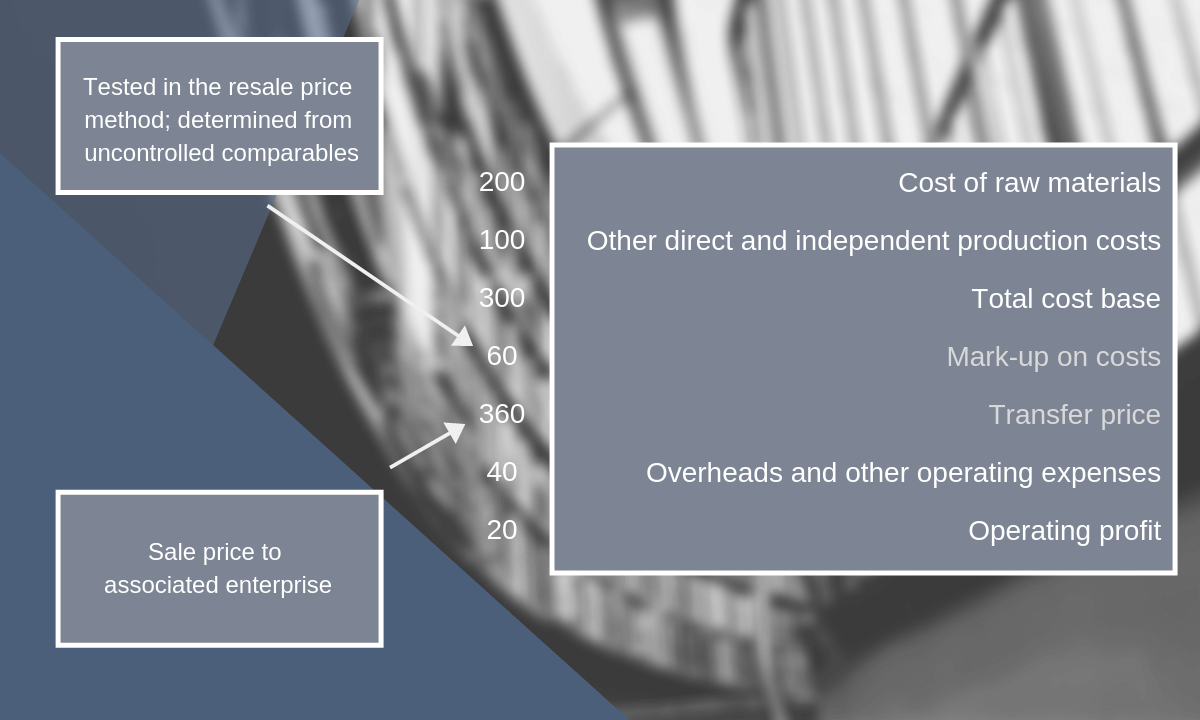

Operating profit is divided by operating assets only tangible assets in general. The OECD Guidelines state that a transfer price or profit margin that is within the arms length range is consistent with the arms length principle. Determine Net Margin Realised.

Step 7 Transfer Price can be arrived using the arms length margin as determined in step 6. Transactional Net Margin Method TNMM for Transfer Pricing a. It is important to note that although the.

The company implements a transfer-pricing policy of targeting an operating margin of 5 for US. If we add to. Transaction Net Margin Method TNMM This method doesnt look at the resale price but instead compares net profit margin as in the final profit after all costs against the net profit margin.

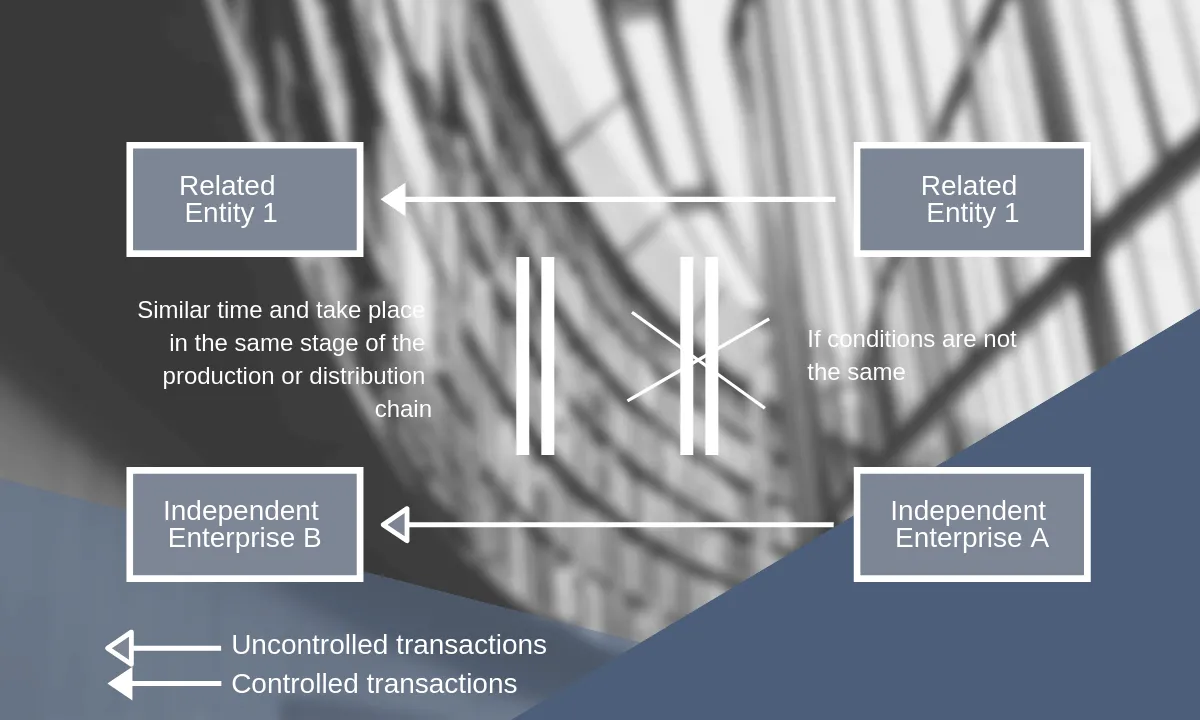

The application of transfer pricing methods helps assure that transactions conform to the arms length standard. We saw that the total cost of the services is 125000 USD. To achieve a high degree of comparability.

The net margin realised by the enterprise from an international. Transactional methods of determining transfer pricing Transactional Net Margin Method TNMM This method is also called global margin method. Its aim is to determine the.

Transfer pricing methods are ways of calculating the profit margin of transactions or an entire enterprise or of calculating a transfer price that qualifies as being at arms length. To calculate the transfer price one simply has to add the Net Cost Plus Margin to the existing total cost. The best way to do this is to add a margin onto the cost where you compile the standard cost of a component add a standard profit margin and use the result as the transfer.

Tp Bible On Twitter 2 111 Transferpricingguidelines Visualization Example Of The Tnmm This Is The Case Used In The Exemple Of The P 2 59 Regarding Cpm If Gross Margin Is Not Comparable And Adjustments

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Methods Crowe Peak

Transfer Pricing Meaning Examples Objectives Purpose

The Transactional Net Margin Method Explained With Example

The Transactional Net Margin Method Explained With Example

Transfer Pricing Methods Crowe Peak

Transfer Pricing Definition Optimal Price Determination Examples

The Transactional Net Margin Method Explained With Example

Everything You Need To Know About Transfer Pricing Incorp Advisory

Transfer Pricing Methods Royaltyrange

The Five Transfer Pricing Methods Explained With Examples

The Five Transfer Pricing Methods Explained With Examples

Brief Information About Traditional Transfer Pricing Methods Download Scientific Diagram

The Five Transfer Pricing Methods Explained With Examples

Transfer Pricing Methods Royaltyrange

Everything You Need To Know About Transfer Pricing Incorp Advisory